Start receiving paid survey opportunities in your area of expertise to your email inbox by joining the All Global Circle community of Physicians and Healthcare Professionals. They were able to keep over $860,000 of their earned income in that ten-year timeframe. Multiply their annual tax bill times 10 and they’ll pay about $134,000 in total taxes on a million dollars of earned income when spread out over a decade. Isn’t it remarkable that the federal income tax was negligible with $100,000 in household earnings?

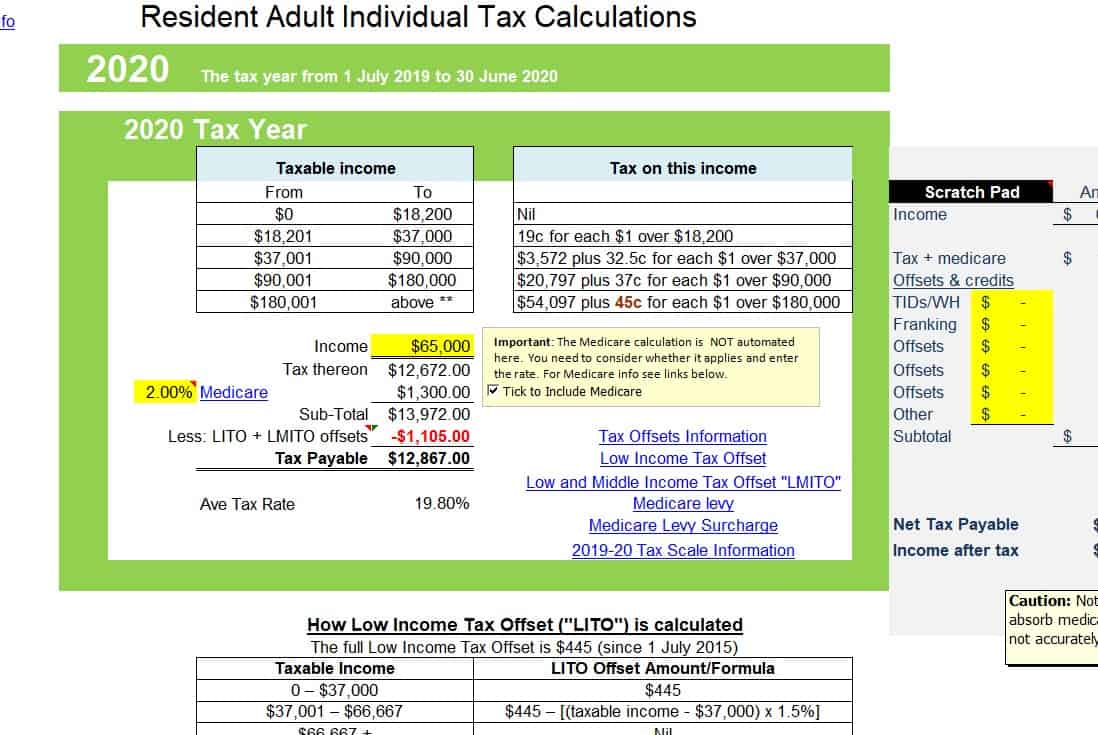

Note that about 2/3 of this consists of payments to Social Security, and they should get at least some of that back, eventually. Note that you don’t get deductions on the FICA taxes, which are based on the $100,000 salary.Īt 5% of $35,900, the state & local income tax will be $1,795.Īdd it all up and their tax bill based on 2021 tax brackets and rates will be a total of $13,358 or 13.4% of their salary. Their share of the FICA taxes will be $6,200 for Social Security and $1,450 for Medicare.

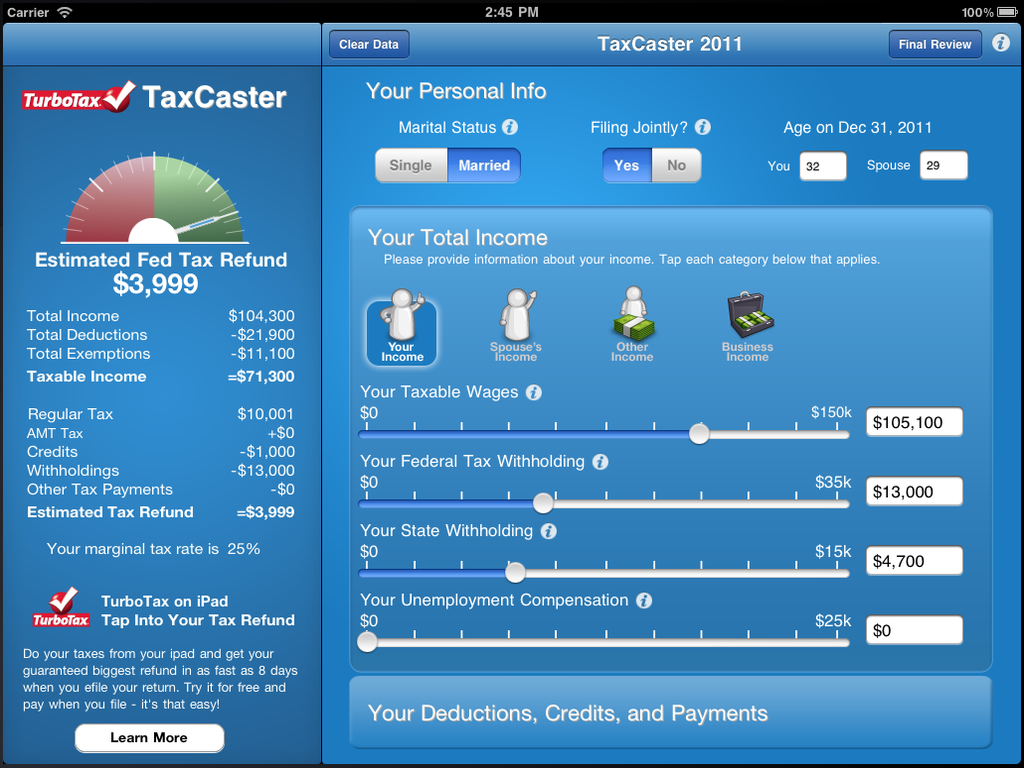

The tax calculation on $35,900 of taxable income gives them a federal income tax of $3,913, according to TaxCaster.

After subtracting the $25,100 standard deduction and $39,000 in tax deferral, they’ll owe federal income tax on just $35,900 or 35.9% of that $100,000 income. The combined salaries in our first household add up to $100,000 a year. Depending on your tax situation, you may be able to file for federal and state income taxes for free with TurboTax. Again, the numbers below are calculated for income earned in 2021.Īll calculations were made with assistance from TurboTax TaxCaster. They live in a state with a mid-range total state & local income tax at a flat 5% of their federal taxable income per year. They have no children and thus receive no child tax credit (which can be up to $3,000 per child). This could be any combination of 401(k), 403(b), and/or 457(b) contributions, as long as they have access to two of them. We’ll keep things consistent by looking at married couples with one income, filing jointly while contributing $39,000 a year to tax-deferred retirement plans. In today’s post, we’ll calculate the taxation on households earning $100,000 a year, $250,000 a year, and $1,000,000 a year as W-2 employees in 2021, with taxes due in 2022. It depends greatly on how long it takes to accumulate those earnings. Taking a deep dive into first-world problems, we’ll see precisely how much one might pay in taxes on a million-dollar annual salary or in taxes on a million dollars of earned income over longer timeframes.

0 kommentar(er)

0 kommentar(er)